AuthorChris Lawson

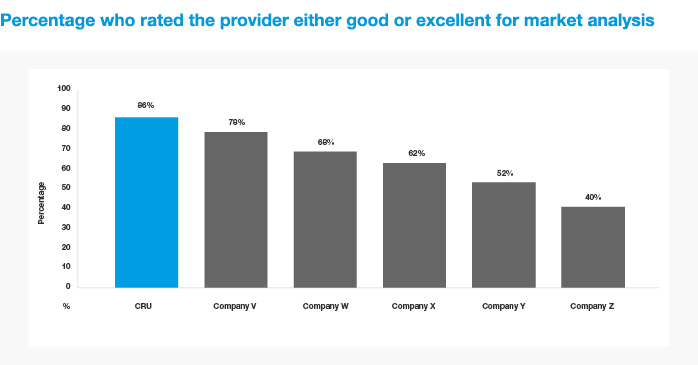

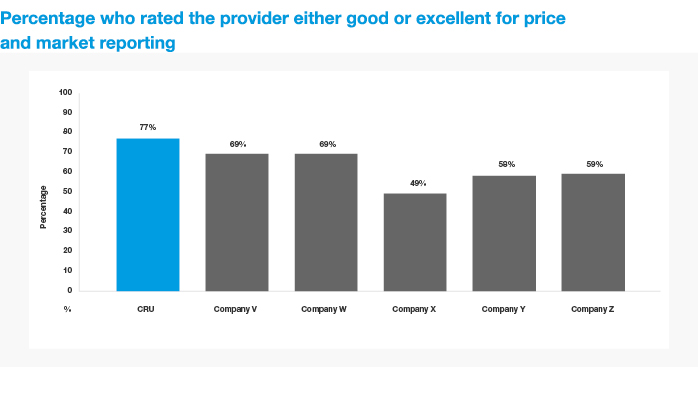

Head of Fertilizers View profileCRU’s Fertilizers team is the most highly rated by the global market on both quality of market analysis and on price reporting, according to new independent market research.

The global research amongst companies who purchase information from third-parties found that 86% of respondents rated CRU’s market analysis and forecasting as excellent or good, while 77% rated its price assessments and market reporting as excellent or good. Both results were significantly higher than the next best provider, according to the research carried out by Fusion Insight.

The research was conducted from a random selection of producers, consumers, financials, traders, suppliers and other parts of the global fertilizers industry. Respondents also came from a broadly representative mix of regions. CRU’s name was not identified as being associated with the research so as not to bias the results.

When asked about performance against specific criteria, CRU was the most highly rated provider in terms of transparency of methodology, coverage across commodities, value for money, interaction with analysts/assessors, and accuracy/reliability of data.

This final category was the most valued criteria for stakeholders selecting a provider to work with –82% of respondents rated the accuracy and reliability of CRU’s data as good or excellent. The importance put on accuracy and reliability underlines the value of CRU’s long history in fertilizer analysis and price assessment.

The research also found that CRU’s prices – published in Fertilizer Week – were the most respected and relied upon by both North American and South American respondents.

Of the respondents who use a price provider’s assessments to help inform negotiations, two thirds used CRU’s Fertilizer Week for reference; this compared to less than 45% who used the next most popular provider. When asked to name the best provider of prices for reference, CRU was most often cited. In fact as many respondents named Fertilizer Week as the next five price providers put together.

Further, about a third of price users embed Fertilizer Week prices in contracts, compared to a quarter who used the next most popular price provider. Again, when asked to name the most reliable price to use in contracts, Fertilizer Week was the most popular choice.

Unlike some other commodity markets, the fertilizers industry remains one more likely to base contracts on a basket of two or more providers. However, although there were many variations in the mix of providers used by respondents, CRU was significantly more likely to appear than any other provider.

When respondents used both CRU’s prices and that of its closest competitor, CRU was the most popular for use for reference in negotiations and in contracts.

Explore this topic with CRUFertilizer team