The zinc market was dominated by cost pressures in 2023, which hit both demand and supply and set back the post-Covid recovery in many countries. In this Insight, we are identifying key themes for the zinc market in 2024, which we plan to return to in greater detail as the year progresses.

1. Huoshaoyun could be a game-changer for Chinese supply

Construction is currently underway at the now fully-permitted Huoshaoyun Pb-Zn project in China. With a design capacity of 2 Mt/y (500,000 t/y zinc contained), it will account for more than 10% of China’s total mine output once it reaches full capacity in 2025. The first concentrate delivery from the mine is expected in 2024.

Construction of the integrated 500,000 t/y smelter project, Kunlun Zinc, is expected to start later this year. The increase in China’s mine and smelter output as a result of the Huoshaoyun mine and Kunlun Zinc smelter is likely to result in lower imports of concentrate and refined metal. It could also lead to the closure of several small-scale Chinese mines with high operating costs and cause further consolidation in China’s smelting sector.

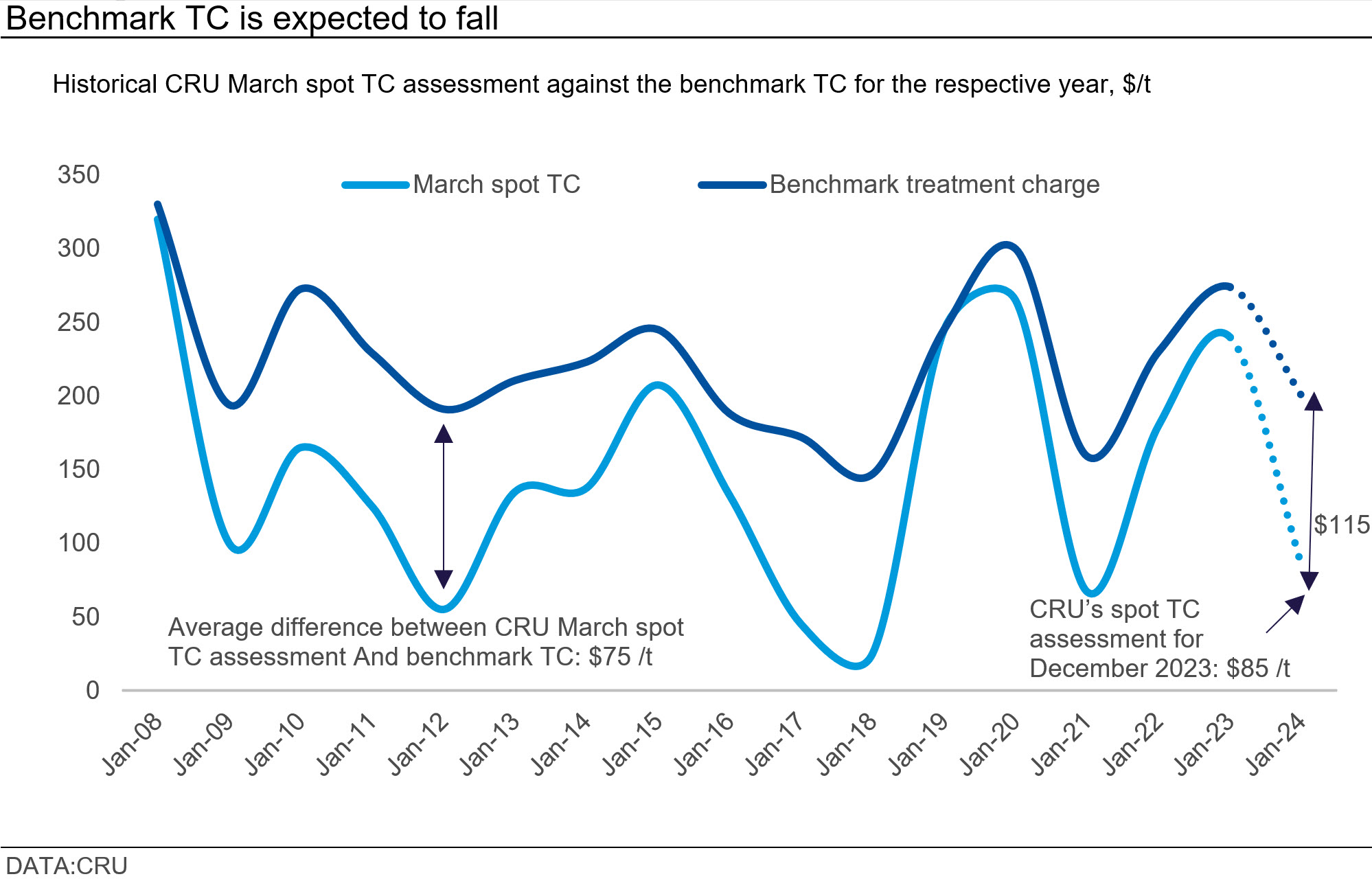

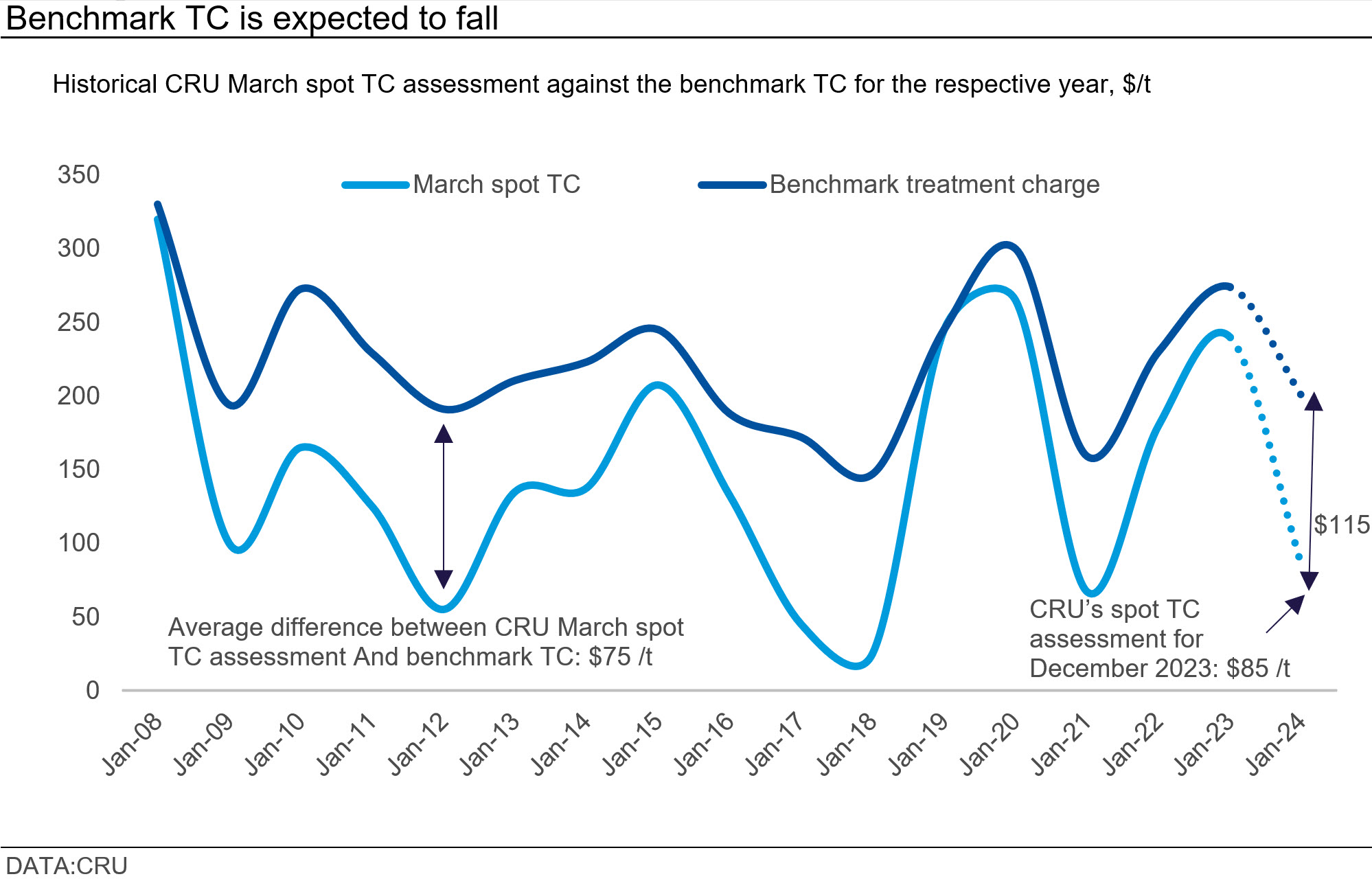

2. China miners will have the upper hand in 2024 benchmark TC negotiations

CRU expects demand for zinc concentrate to outstrip supply for a second consecutive year in 2024. Meanwhile, spot TCs fell for 12 months until November 2023. As a result of the decline in spot terms last year and the concentrate deficit, we anticipate miners will have the upper hand in the upcoming benchmark negotiations and will be able to settle terms at $200 /t, down from $274 /t in 2023.

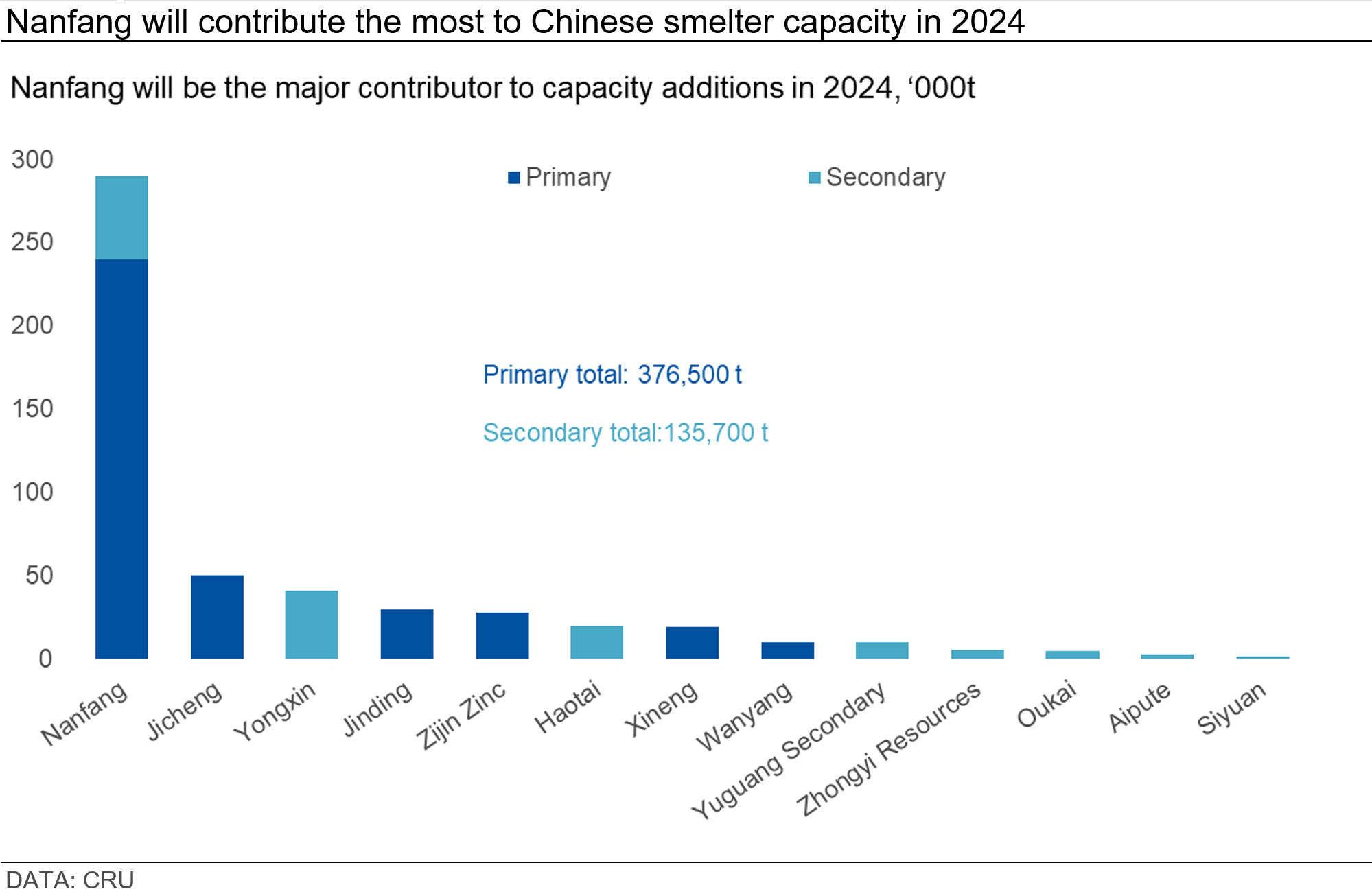

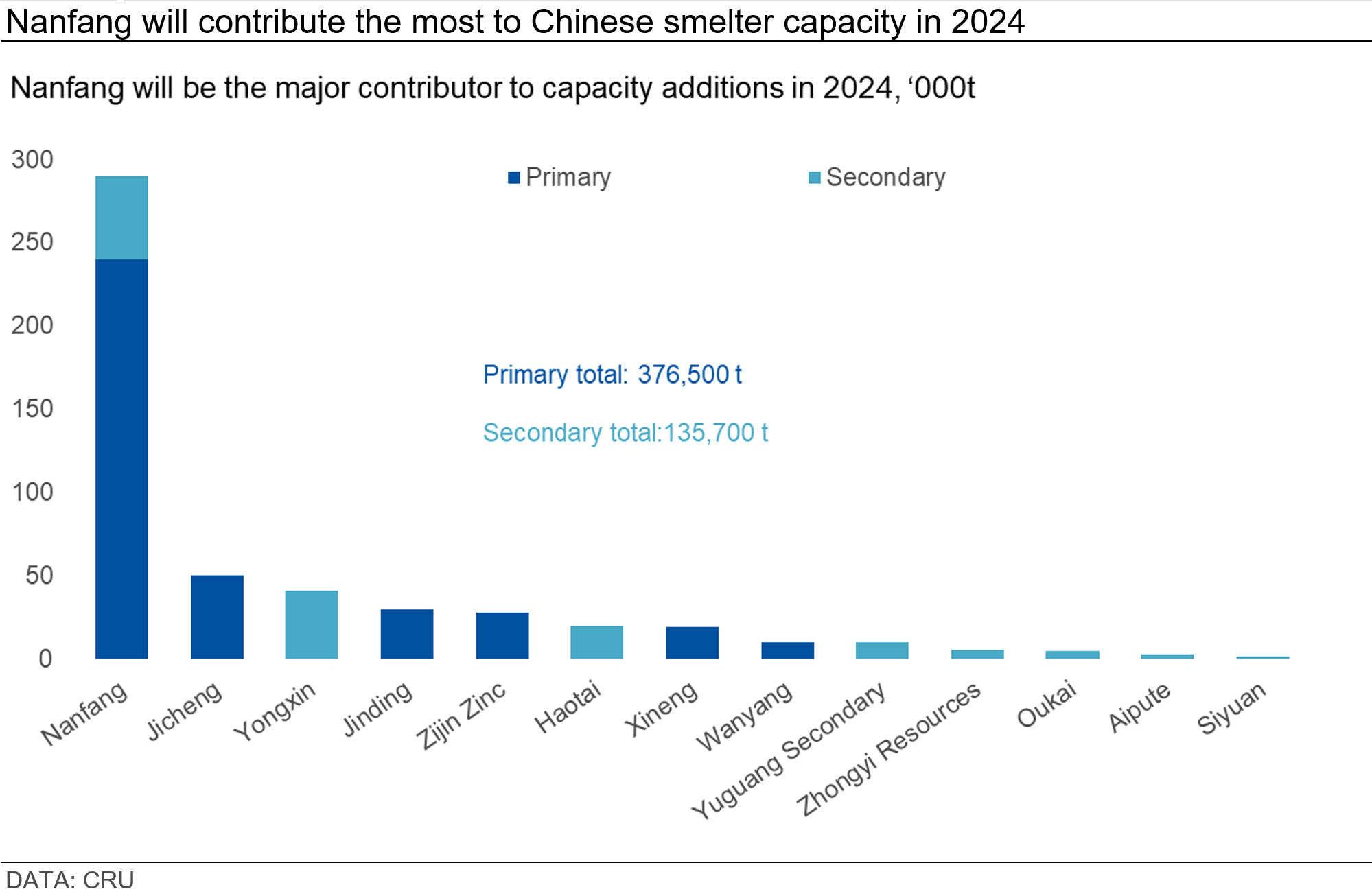

3. Chinese refined output growth may be constrained by concentrate tightness

Chinese smelter capacity will continue to grow this year due to a number of new projects and expansions. However, growth in refined output is expected to be constrained by zinc concentrate shortages and the permanent closure of Yuntong Zinc and Dongling vertical retort smelters.

4. Ex. China smelter capacity will increase but sector underinvestment will remain an issue

Ex. China has seen very little smelter capacity growth since the early 2000s. In 2024, we expect to see the start-up of Boliden’s 150,000 t/y expansion at Odda in Norway and the new 120,000 t/y Verkhny Ufalei smelter in Russia. However, underinvestment in ex. China smelter capacity looks set to continue beyond this year, with almost no further increases expected over the forecast period to 2028.

5. Logistical issues may impact metal premia

Metal premia in Europe and the USA tumbled last year due to the post-Covid normalisation of freight rates and weak demand. However, recent attacks on container ships in the Red Sea have led to a sharp increase in freight rates for vessels, which are now being diverted around the Cape of Good Hope. This has not only impacted shipping routes between Asia and Europe but between Asia and the US East Coast too. This could put a floor under zinc metal premia in the US market, which is reliant on imports from Asia and could even reverse their decline. Reduced shipping traffic through the Panama Canal due to low water levels is also leading to an increase in shipping costs, which could impact concentrate and metal shipments from South America.

6. Substitution and thrifting may accelerate

Increasing galvalume capacity in North America and elsewhere will reduce the zinc usage in galvanising for certain construction applications. Decarbonisation is expected to increase scrap usage in zinc’s first-use sectors (e.g. die casting and brass) and constrain refined zinc demand growth.

7. Elections likely to dampen demand in the short term

Indian demand grew strongly in 2023 as the economy strengthened. However, the general election in April-May 2024 is expected to lead to a slowdown in demand growth due to a pause in infrastructure and other government investment.

US demand entered 2024 on a weak footing but is expected to grow as interest rates begin to fall. However, uncertainty around the outcome of the election in November may dampen demand in the short term. A change in government could lead to increased protectionism and/or a partial repeal of the Inflation Reduction Act. The latter could negatively impact the fast-growing renewables sector.

8. US and European interest rates should start to ease from Q2

Cost pressures had a huge impact on industrial production and zinc demand last year, particularly in Europe but also in the USA. Until interest rates begin to fall, restocking will not start, and growth in both regions will remain limited. CRU expects the ECB and the Fed to begin cutting rates from Q2. This should lead to stabilisation in the European construction sector and a recovery in the US housing market. In the meantime, elevated rates will continue to weigh on zinc demand, but the turning point could come as early as Q3.

Explore this topic with CRU