It is now almost one year since the Guangzhou Futures Exchange (GFEX) launched silicon metal futures trading in China. The exchange has provided an additional outlet for established silicon metal producers but has also attracted new entrants engaged in arbitrage trading to the industry.

Author Li Wang

Senior Analyst View profileThe weak performance of the silicone sector against the remarkable expansion of domestic polysilicon production in 2023 has narrowed the difference between chemical-grade and metallurgical-grade silicon metal prices. Given the design of the futures market, the lower spread has created obvious arbitrage opportunities for market participants. The associated capital inflow not only enlarged the inventory pool of silicon metal but also resulted in a significant price increase during Q3, defying the typical seasonal pattern of price movements in the Chinese market.

Price deviations caused extensive arbitrage trading

A variety of different silicon metal grades are used in polysilicon, aluminium alloy, and silicone production. The first two sectors generally consume metallurgical-grade silicon metal, typically in the form of 5.5.3 grade material, while the silicone industry uses 4.2.1 and 4.1.1 grade material, commonly referred to as chemical grade silicon metal. Given the larger and growing market for metallurgical grade silicon metal, GFEX chose 5.5.3 grade material as the standard deliverable product for silicon futures contracts. However, the exchange also selected an alternative product for delivery in the form of 4.2.1 (chemical) grade silicon metal at a set premium of RMB2,000 /t.

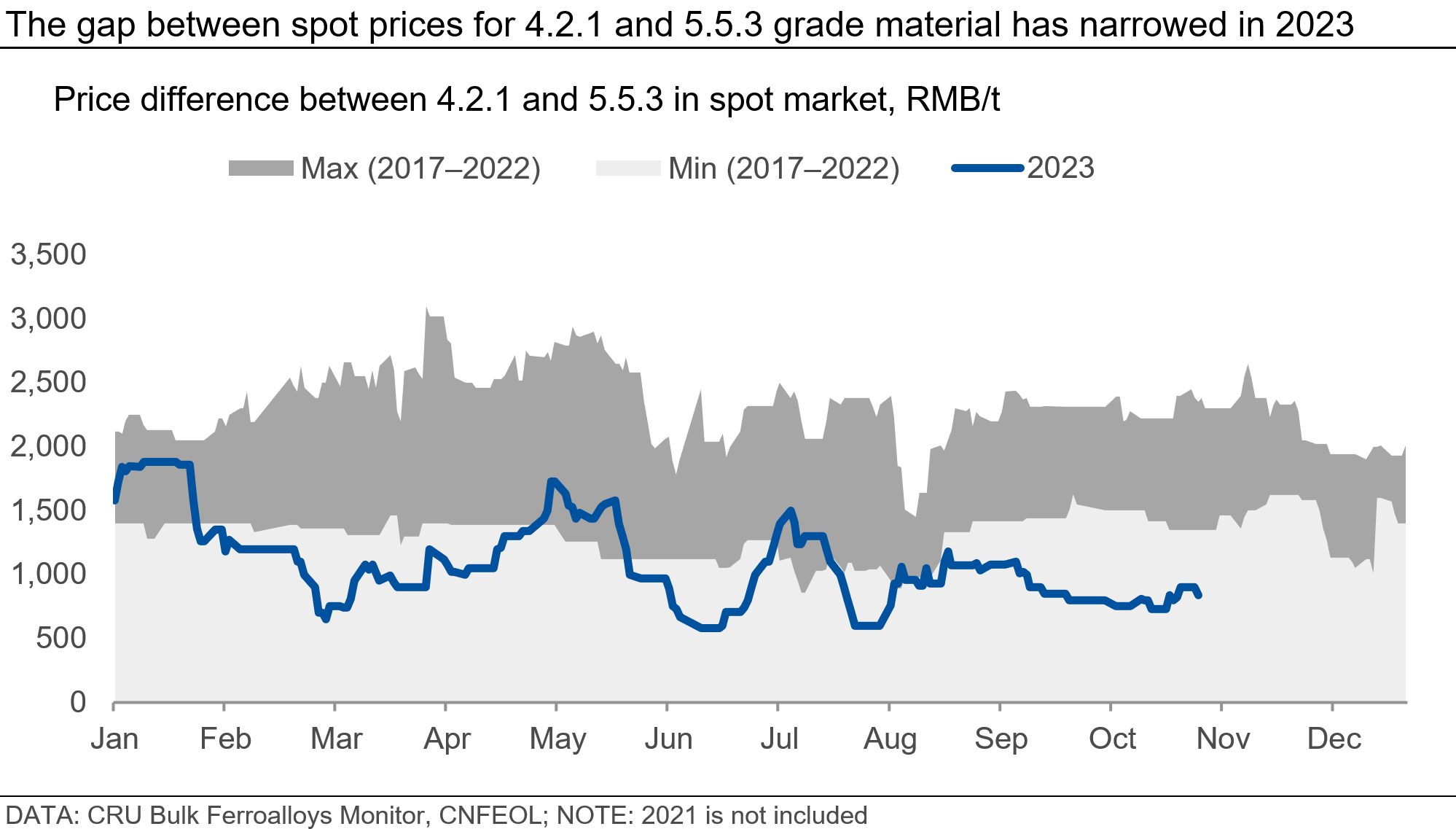

Looking back, the price difference between 4.2.1 and 5.5.3 grade silicon metal was in the range of RMB1,000–3,000 /t between 2017 and 2022, except for 2021 when dramatic volatility occurred. About 80% of the time, the difference was between RMB1,400 /t and RMB2,400 /t. Thus, a premium of RMB2,000 /t for 4.2.1 grade over 5.5.3 grade silicon metal was viewed as a representative and acceptable for initial trading.

However, this year has seen flat demand from the silicone sector, whereas the polysilicon sector has experienced around 70% y/y demand growth. Thus, the difference in spot prices between the 4.2.1 and 5.5.3 grades has narrowed considerably and has consistently been well below the RMB2,000 /t benchmark, with the biggest gap recorded in June 2023.

The arbitrage trade has fuelled a net rise in inventories

The difference between the spot prices for 4.2.1 and 5.5.3 grade material and the set RMB2,000 /t premium has offered a continuous arbitrage window for traders and producers of chemical-grade silicon metal. Traders actively purchased 4.2.1 grade material from the spot market during the rainy season, while smelters sold 4.2.1 product on the futures market. The arbitrage caused destocking in the physical market, offset by a build-up of stocks in futures delivery warehouses.

Combined silicon metal inventories at smelter sites and at ports declined from 272 kt in April 2023 to 173 kt in September before rising to 200 kt in October. In contrast, silicon metal inventories in futures delivery warehouses reached 180 kt at the end of October. As a result, the overall inventory of silicon metal climbed to a record high of 380 kt – equivalent to more than 30 days of domestic consumption.

![]()

Record high inventories, surprising spot price surge during the rainy season

Given the successful destocking at smelter sites and ports, spot prices have increased since August 2023 at a time when silicon metal prices usually surrender to strong rainy season levels of production. Moreover, spot prices have remained comparatively high despite of elevated and record high inventories.

![]()

Although we hold a bullish view on Chinese silicon metal consumption, as detailed in our quarterly Silicon Metal Market Outlook, the entry of arbitrage capital has altered market dynamics. It has created additional short-term demand, but in the process has also increased the overall inventory pool, setting the stage for a more volatile market due to increased speculation.

We’ll keep tracking the market dynamics of silicon metal and provide updates in our Bulk Ferroalloys Monitor and Silicon Metal Market Outlook. Please contact us if you want to know more about the silicon metal market.

Explore this topic with CRU

Author Li Wang

Senior Analyst View profile