Author Paul Butterworth

Research Manager View profile

Madhura Shirodkar

Consultant View profile

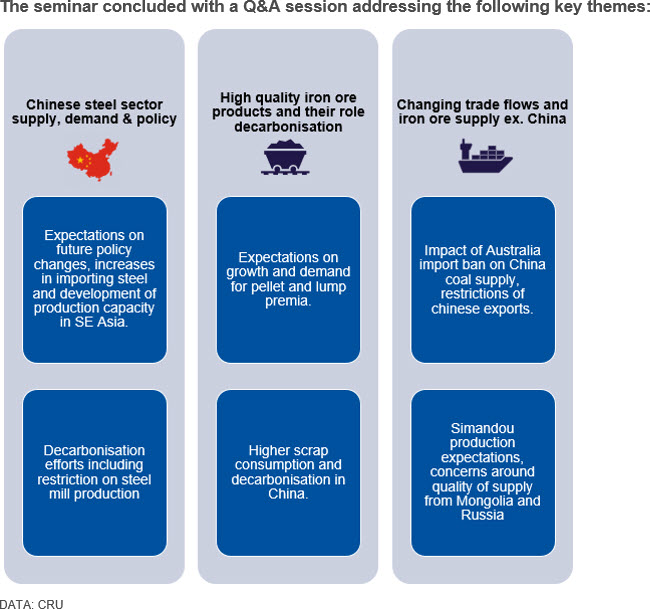

A plethora of challenges were addressed including the ongoing shortage of recycled scrap, high energy prices, limited high-grade coking coal and rising premiums on high quality iron ore products. The seminar also provided a medium- and long-term outlook on the steel market and it’s input raw materials. Rising premiums in various high grade iron ore products and their subsequent effects on decarbonisation efforts were also discussed.

The seminar commenced with updates on the outlook for supply and demand in the steel market. Unsurprisingly, the majority of activity leading to the ongoing price high was found to be centred around China. High steel prices were largely attributed to increasing global demand and supply side constraints. Analysis done using CRU’s Disruptions Tracker observed that Covid-19-related factors had caused nearly 10% of hot metal capacity outside China to remain idled. Further out, hot metal production is expected to fall in the long term. Meanwhile, the scrap contribution to liquid steel production, as well as general scrap availability, is on the rise for the longer term, which bodes well for decarbonisation efforts, but is not sufficient to meet required decarbonisation targets.

Higher steel prices were also observed to be part of a broader commodity rally, triggered by the global news of vaccine rollouts towards end-2020. A more in-depth discussion on the raw materials supply-side showed that iron ore production was responding to the price high, but only marginally. Iron ore suppliers in Brazil were able to increase exports but, in Southern Brazil, these were mostly of lower-grade ores. Iron ore production in China and India has also exhibited a restrained response to the increase in prices. Higher-quality iron ore products, such as lumps and pellets, saw a surge in premia. Supply from smaller producers around the world will provide some uplift to supply in the near term and, further out, upcoming projects in Simandou were expected to cause large increases in seaborne market supply.

Steel prices have not lifted so high in China and Chinese steelmakers’ margins have fallen recently, mainly as China has pulled back somewhat from the export market and diverted more of its production to the domestic market. The high domestic coal price due to the ban on Australian coals has also disadvantaged Chinese steelmakers relative to their peers elsewhere, which has impacted their relative margin performance.

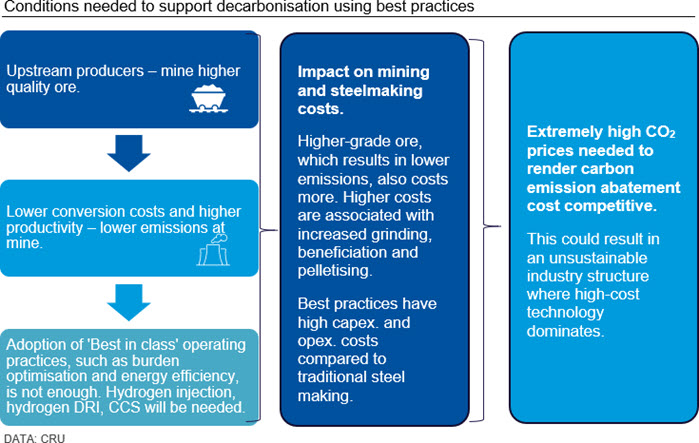

The seminar also explored options available to the steel industry to shift towards decarbonisation by using the Chinese steel sector as a case study. Scope 1 and 2 emissions at the steel mills were found to be 10 times higher than scope 3 emissions, but decarbonisation in steel mills begins upstream, from the quality of iron ore produced, as this subsequently affects steel making efficiency. On the downstream side, steelmakers need to adopt best practices that prioritise decarbonisation with existing assets. Some of these best practices include installation of energy efficient technology, optimisation of the blast furnace (BF) burden (e.g. with high-grade ore) and use of lower carbon injectants, such as natural gas. Ultimately, this will not be enough and zero-carbon metallics (e.g. DRI), the use of hydrogen injection to replace pulverised coal injection and the application of CCS where feasible could allow existing assets to continue to be operated whilst meeting decarbonisation targets. Adoption of these measures could lead to a 40% to 60% cut in CO2 emissions by 2035 compared with 2020, whilst retaining existing technology. Further analysis revealed that the conditions required to make many of these measures cost competitive could lead to a non-viable structure of the steel sector in the long run (See chart above).

To discuss this insight in more detail, or to request a copy of the presentations from the CRU Singapore Steel and Raw Materials Seminar, please complete this form and we will be in touch.

Explore this topic with CRU

Author Paul Butterworth

Research Manager View profile

Madhura Shirodkar

Consultant View profile