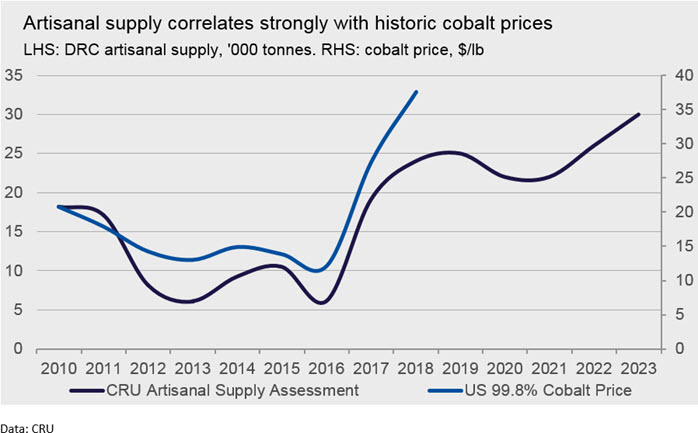

Cobalt demand has grown by 21% between 2016 and 2018 and CRU forecasts that it will increase a further 55% out to 2023, due to the increasing uptake of electric vehicles.

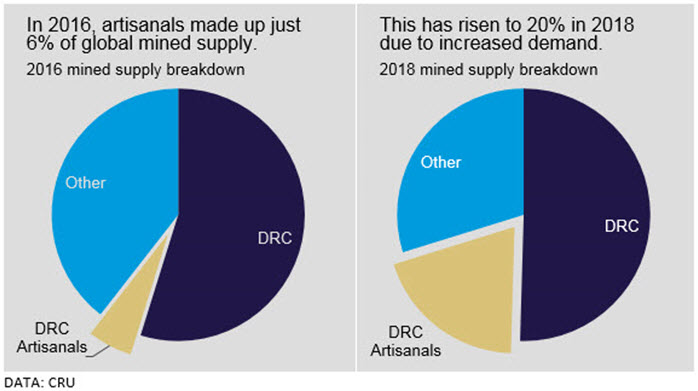

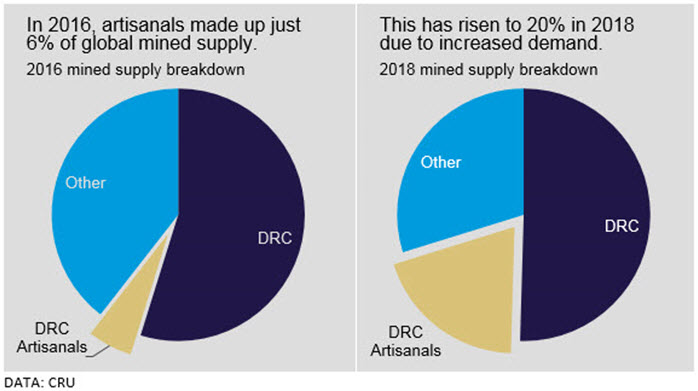

Currently, the majority of the cobalt supply comes from the DRC (Democratic Republic of Congo) where, in addition to the large-scale global mining companies, artisanal miners utilise small pockets of land not owned by large-scale miners to produce cobalt.

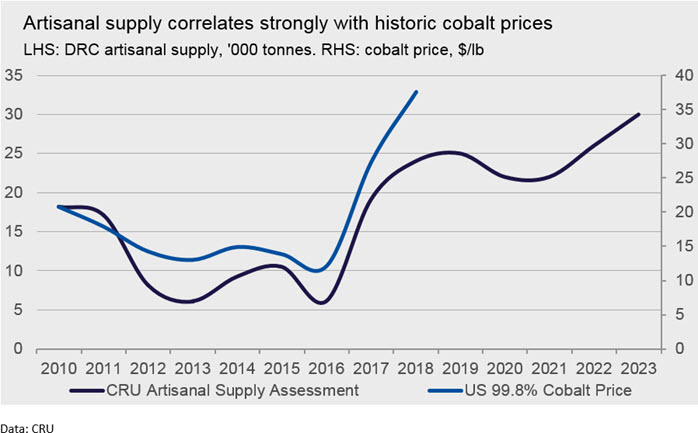

It is believed that as many as 100,000 diggers, sorters and washers are involved in the artisanal mining trade in the DRC. Artisanal miners often work independently and sell their ore to local co-operatives, who sell it to local merchants and traders, who in turn sell to international traders. When done correctly, artisanal mining can be an ethical source of low-cost, high-grade cobalt which also puts income directly into the hands of locals with very few alternative options available to them. Artisanal mining in the DRC has increased dramatically between 2016 and 2018 on the back of strong demand growth and rising prices.

Artisanal mining has been key in satisfying skyrocketing cobalt demand in recent years. However, the practice raises many ethical concerns. Child labour is rampant in the artisanal mining sector, as many regions suffer from abject poverty and lack a functioning schooling system – in 2014, UNICEF estimated that 40,000 children were involved in artisanal mining of all commodities produced in the DRC. As a result, Western companies have sought to distance themselves from artisanal cobalt supply in the past to forego the risk of inadvertently using raw materials sourced from child labour. The low wealth generated by these practices has also come under scrutiny. Traders of artisanal cobalt concentrates will typically sell material for around 40-50% of its cobalt value, while the artisanal miners will typically only receive 1-3% of the intrinsic value of their ore. A lack of reliable information and the complexity of the supply chain makes artisanal mining far more challenging to track as a source of cobalt supply than traditional mining sources.

Can Blockchain provide a traceability solution?

Blockchain technology can increase transparency in mineral supply chains and provide a traceability solution, while reducing the need to have a one central owner of the database. A Blockchain system starts with a mine site audit to check there is no child labour. Once the audit is passed, the mines are given ‘approved bags’ with bar codes into which the ore is placed before sealing and being passed to merchants and traders. The bar codes can be scanned at any point, and the ore’s journey can be tracked on a public ledger which is where the Blockchain comes in.

The advantages of a Blockchain system include:

- Increased transparency – tracking minerals from mine to end user.

- Reduced cost – as the number of audits needed declines.

- Lower risk of fraud and increased trust – immutable data which once validated and uploaded cannot be changed.

- The Incentivisation of responsible production – by allowing downstream/upstream companies to distinguish themselves as responsible purchasers/producers, discouraging unethical artisanal mining activity.

However, even a Blockchain enabled system is not without risks. The biggest risk is the formation of a black market for ‘approved bags’, whereby mines who pass their audit and get ‘approved bags’ then sell these bags to other mines who have failed their audit, destroying the purpose of the bags and losing traceability. Nevertheless, we expect big suppliers will counteract such a black market by forming a coalition of credible, ethical producers who have passed the mine audit. Participation in a black market would lead to elimination from the coalition.

The advantages of Blockchain are evident – if used for cobalt tracking it has the potential to provide a traceability solution and reduce child labour. A report by Amnesty International1 uncovered that several companies including Apple, Samsung and LG Chem have come under fire for purchasing cobalt which originated from artisanal supply in recent years. These companies are increasing pressure on their upstream suppliers to improve traceability and working conditions, which has also had the effect of making artisanals more attractive to end users.

Existing producers are making efforts to increase traceability:

- Traxys, a leader in financial and logistical solutions for the mining and energy industries has signed a letter of intent to develop traceable artisanal mining with the company ‘Cobalt Blockchain’ in the DRC2.

- Major carmaker Ford will use IBM’s Blockchain platform to monitor supplies of cobalt from a Chinese owned mine in DRC, to ensure they are ethically sourced. Ford will work in collaboration with Huayou Cobalt, one of the biggest producers of cobalt for batteries, and South Korean cathode producer, LG Chem. The effort is being overseen by RCS Global, a UK supply chain audit company3.

- London Metal Exchange has agreed to back a Mercuria-led blockchain-based system to track global metals4.

Blockchain technology is enabling these developments and provides a way to increase transparency in supply chains. As the benefits unfold, we expect more producers will embrace and implement Blockchain technology to track their supply chains.

Endnotes:

- https://www.amnesty.org/en/latest/news/2017/11/industry-giants-fail-to-tackle-child-labour-allegations-in-cobalt-battery-supply-chains/

- https://www.newswire.ca/news-releases/cobalt-blockchain-and-traxys-announce-cobalt-hydroxide-plant-joint-venture-cobalt-off-take-agreement-and-us30-million-trade-finance-facility-690284581.html

- https://www.ft.com/content/d5ba0434-1979-11e9-9e64-d150b3105d21

- https://www.ft.com/content/ad8e9d58-4fd9-11e9-b401-8d9ef1626294

Explore this topic with CRU