Co-author Panos Kotseras

Head of Stainless Steel Raw Materials View profile

The effects of these changes are expected to be relatively limited, however, Indonesia is losing its developing country exemption that is likely to restrict their export volumes of stainless into the EU significantly.

The European Commission implemented amendments

The European Commission implemented adjustments to the safeguard measures, due to come into force on 1 October. These are modifications which aim to balance pressure from steelmakers to tighten the safeguards and importers’ interest in maintaining regular trade flows.

In this spotlight we focus on the effect of the new regulations on Indonesian stainless exports; if you have any question regarding the other amendments please get in touch with us to discuss.

The following are the eight main implemented changes to the safeguard quotas:

- Indonesia is no longer exempted from the safeguards for stainless flat products and seamless tubes.

- Individual countries cannot use more than 30% of the global quota, for products with a global quota (HR coil, large welded tubes).

- The large welded tubes product group will receive a global quota in line with the hot rolled coil quota.

- For rebar and wire rod individual countries cannot use more than 30% of the Other Countries quota once it is made available to countries that have filled their own quotas in the last quarter of the quota period (calendar Q2).

- The annual increase of the quota volume per period will be reduced from 5% to 3%. This would apply to the second half of the current quota period starting from 1 October and would retroactively lower the total available quota volume.

- The category A (non-automotive) metallic coated sheet quota has been expanded to include the CN codes previously unique to category B metallic coated sheet quotas. Category B will remain untouched and will apply to the same trade codes as previously.

- Material imported under the category B (automotive grade) metallic coated sheet quota will need to prove end-use in the automotive sector.

- India will – uniquely – have its metallic coated sheet quotas merged into one.

Indonesia stainless exports likely to fall

Capitalising on competitive NPI (nickel pig iron) production, Indonesia has built an integrated stainless steel industry in the last three years which is reshaping the global market. While Indonesia has so far been exempted from the EU safeguards due to its WTO definition as a developing country, the EC decided to incorporate Indonesian stainless steel into the safeguards.

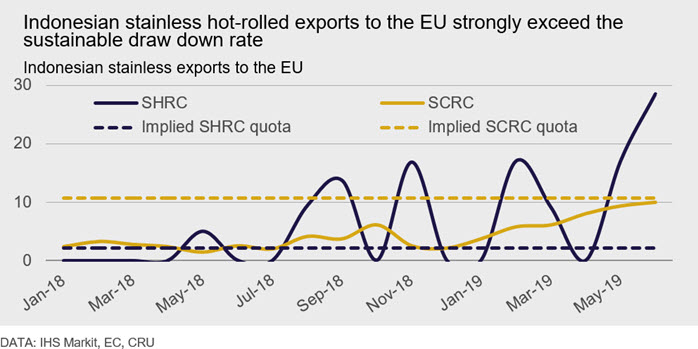

Indonesian exports of cold-rolled and hot-rolled stainless steel are now part of the “Other countries” (OC) quota. This decision is bound to have a big impact on Indonesian stainless hot-rolled exports because the OC quota volume for this period is limited to only 25.7 kt for a whole year. As shown in the chart below, Indonesian stainless hot-rolled coil (SHRC) exports have increased significantly since mid-2018. Nearly 30 kt of Indonesian SHRC was imported in June alone, already exceeding the total annual quota volume for OC in one month. This is likely to disincentivise further imports from Indonesia. However, uncertainty remains as Indonesian stainless is competitively priced.

During the period the EC initially assessed imports into the EU Indonesian stainless exports were too small to justify a country specific quota. This year Indonesian SCRC exports to the EU have risen materially from year-ago levels. In June, exports were equivalent to the sustainable drawdown rate of the OC quota for SCRC, however, the OC quota is supposed to include other countries too. Currently, this quota is not in danger of filling up early, but additional draw down from Indonesia will make it highly restrictive. We expect that Indonesia will be the largest exporter in the SCRC OC quota group. That is likely to restrict smaller SCRC suppliers in the OC category.

Safeguard measures leaner and more effective

The adjustments to the safeguard measures will increase their effectiveness at their stated goals slightly without distorting the current system. The changes are targeted against countries that either started exporting more aggressively since the reference period (e.g. stainless products from Indonesia or carbon hot-rolled coil from Turkey) or overuse the quotas. The lower rate of increase of the quota volumes will only slightly reduce imports and support the output of regional mills, though the effect will be tempered by weaker demand growth in 2019. All other changes are only cosmetic in nature and will not impact the market considerably.

Explore this topic with CRU

Co-author Panos Kotseras

Head of Stainless Steel Raw Materials View profileThe Latest from CRU

Decarbonisation will reshape global steel trade flow

CRU’s Steel Long Term Market Outlook presents comprehensive analysis of global steel trade flows until 2050. Decarbonisation will play a significant role in redefining...